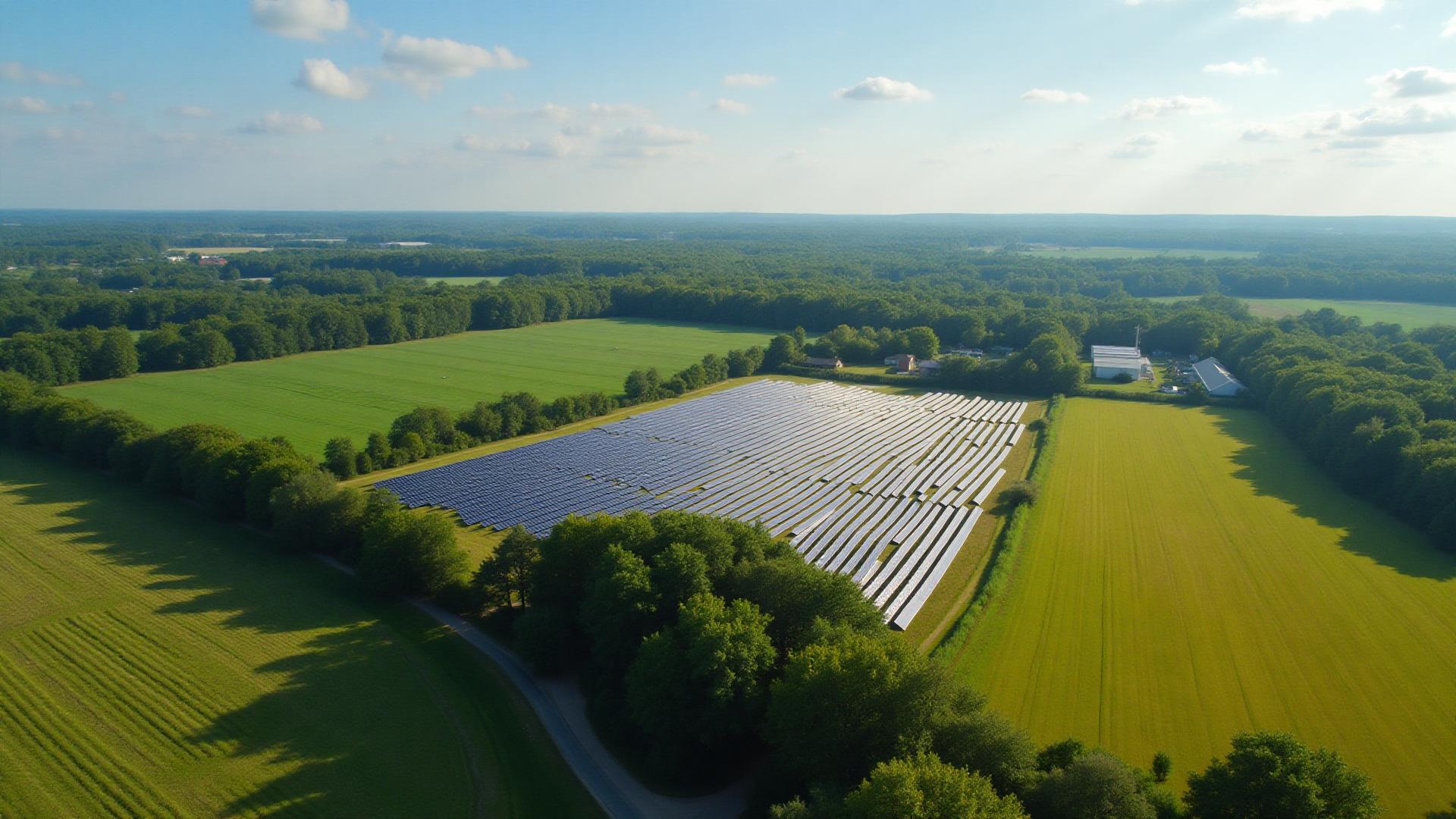

Solar Development and Real Estate Value in Maryland 2025

One of the most common questions Maryland landowners ask is: "How will solar development affect my property value?" As Maryland's leading solar developer, Matrix Solar has extensive experience with real estate impacts and can provide data-driven answers.

The Short Answer: Solar Leases Increase Landowner Wealth

Solar leases significantly increase the financial value of land to the owner through guaranteed income, even if the assessed property value methodology doesn't always reflect this benefit. Maryland landowners with solar leases enjoy stable, inflation-protected income that far exceeds traditional agricultural returns.

Understanding Property Value vs. Income Value

It's important to distinguish between different types of "value":

- Market Value: What a buyer would pay for the property

- Assessed Value: County tax assessment used to calculate property taxes

- Income Value: The financial return the property generates for the owner

- Economic Value: Total benefit to the owner including income and appreciation

Impact on Host Property Value

Financial Benefits to Landowners

For property owners who host solar development, the financial benefits are substantial:

- Lease Income: $800-$1,500+ per acre annually in Maryland

- Guaranteed Payments: 25-30 year contracts with inflation escalators

- No Operating Costs: Developer covers all maintenance and insurance

- Increased Total Value: Net present value of lease income often exceeds land purchase price

- Estate Planning Benefits: Reliable income stream for heirs

Property Tax Implications

Maryland solar projects are typically taxed as personal property (equipment) rather than increasing land assessment:

- Land remains in agricultural or similar tax classification

- Solar equipment taxed separately (usually paid by developer or built into lease)

- No dramatic increase in property taxes for landowner

- Some counties offer additional tax incentives for renewable energy projects

Marketability of Properties with Solar Leases

Properties with existing solar leases often command premium prices because:

- Guaranteed Income: Buyers value predictable cash flow

- Professional Management: No landlord responsibilities for buyer

- Investment Appeal: Attractive to investors seeking stable returns

- Remaining Lease Term: Long-term contracts (15-20+ years remaining) particularly valuable

Impact on Neighboring Properties

One of the biggest concerns is how solar farms affect nearby property values. Research and market data provide reassuring answers:

Peer-Reviewed Research Findings

Multiple academic studies have examined solar farm impacts on neighboring property values:

- University of Texas Study (2023): Found no statistically significant impact on adjacent residential property values

- University of Rhode Island (2022): Properties within 1 mile of solar farms showed no depreciation

- National Renewable Energy Lab (2021): Well-screened solar projects had minimal to no impact on neighbor property values

Maryland Market Data

Analysis of Maryland property sales near existing solar farms shows:

- No consistent pattern of price reduction for properties adjacent to solar farms

- Properties within 0.5 miles sold at comparable prices to regional averages

- Well-landscaped projects with visual screening saw no measurable impact

- Some rural properties appreciated faster than county averages (data from Frederick and Washington Counties)

Why Solar Farms Don't Depress Neighbor Values

Several factors explain the minimal impact:

- Visual Screening: Vegetative buffers and setbacks minimize visibility

- No Nuisance Factors: Solar farms produce no noise, odor, traffic, or pollution

- Low Profile: Panel height (typically 10-15 feet) is less obtrusive than farm buildings

- Improved Aesthetics: Often more attractive than intensive agriculture or vacant land

- Community Benefits: Tax revenue and environmental benefits improve local perception

Matrix Solar's Neighbor-Friendly Design

Matrix Solar takes proactive steps to ensure our projects are good neighbors:

Enhanced Setbacks

- Minimum 100-foot setbacks from property lines (often 150-300 feet from residences)

- Additional buffering near homes and public roads

- Topography analysis to minimize visibility

Comprehensive Visual Screening

- Multi-layer vegetative buffers using native species

- Visual impact assessments from neighboring viewpoints

- Evergreen plantings for year-round screening where needed

- Coordination with neighbors on screening preferences

Community Engagement

- Early notification and meetings with nearby property owners

- Response to neighbor concerns during design phase

- Good neighbor agreements when requested

- Ongoing communication during construction and operations

Comparing Solar to Other Land Uses

How do solar farms compare to other potential neighbor impacts?

Neighbor Impact Comparison:

- Solar Farm: No noise, no odor, minimal traffic, low visual impact with screening

- Traditional Farming: Seasonal noise (equipment), pesticide drift, dust, early morning activity

- Livestock Operations: Odor, potential water contamination, animal noise

- Residential Development: Permanent density increase, traffic, light pollution

- Industrial/Commercial: Truck traffic, noise, lighting, potential environmental concerns

Special Considerations for Different Property Types

Agricultural Properties

For working farms considering solar development:

- Diversification Value: Solar income reduces agricultural risk

- Succession Planning: Makes it easier to pass farm to next generation

- Partial Development: Solar on portion of land while continuing farming on remainder

- Future Flexibility: Land returns to agricultural use after solar decommissioning

Residential Estates

Large residential properties (10+ acres) with solar potential:

- Solar typically on back portions of property away from residence

- Homeowner maintains private residential use

- Steady income enhances overall property value

- Attractive to buyers seeking rural income properties

Investment/Timber Properties

For landowners holding property as investment:

- Solar lease provides superior return to timber or hunting leases

- No harvesting or management obligations

- Long-term contracts provide stable returns

- Property remains marketable to multiple buyer types

Real Estate Professional Perspectives

Maryland real estate professionals who work with solar properties report:

- Commercial/Farm Brokers: Solar leases make properties more attractive to investors and increase marketability

- Appraisers: Income approach valuations significantly enhanced by solar lease revenue

- Residential Agents: Well-designed solar farms generate minimal concern from nearby home buyers

Case Studies: Maryland Property Values

Frederick County Example

A 150-acre farm in Frederick County with 100 acres under solar lease:

- Annual Lease Income: $120,000

- 25-Year Income: $3+ million total

- Property Tax Impact: No increase in land assessment

- Market Value: Sold for 40% premium over comparable farms without solar income

Washington County Example

Residential property analysis near solar farm completed in 2021:

- 15 home sales within 0.5 miles analyzed (2021-2024)

- Average sale price: $385,000 vs. county average of $375,000

- Days on market: 45 vs. county average of 52

- Conclusion: No negative impact detected

Addressing Lender and Title Concerns

Mortgage Implications

Lenders generally view solar leases positively:

- Lease income can qualify for mortgage financing

- Standard solar lease provisions allow mortgage subordination

- Lenders appreciate predictable income stream

- No structural improvements to land that complicate financing

Title and Easement Issues

Matrix Solar works with title companies to ensure clean transactions:

- Solar lease recorded like any other lease or easement

- Clear provisions for lease transfer with property sale

- Standard title insurance endorsements available

- No cloud on title after lease expiration

Long-Term Property Value Trajectory

Looking ahead 20-30 years:

- During Solar Lease: Enhanced value due to income stream

- After Decommissioning: Land returns to original use with improved soil health

- Future Development Potential: Options preserved for next generation

- Maryland's Growth: Land values likely to appreciate regardless of solar presence

Maximize Your Property's Financial Potential

Matrix Solar helps Maryland landowners unlock substantial value from their property through solar development. Our projects enhance your financial position while preserving long-term property value and flexibility. Contact us for a confidential property value analysis and solar lease assessment.

Related Articles

Maryland Solar Land Lease Rates: 2025 Complete Guide

Discover what Maryland landowners can earn from solar leases, including per-acre rates and payment structures.

Solar Easements and Property Rights in Maryland

Understand how solar easements work and what property rights landowners retain during solar development.

Maryland Solar Property Requirements: Is Your Land Suitable?

Learn the key factors that determine if your Maryland property qualifies for profitable solar development.